Taxes In Germany 2024

Taxes In Germany 2024. In 2024, there will be a number of changes in germany in the area of vat and other indirect taxes and duties. Any taxes owed will be automatically withheld by your employer.

The inflation rate is measured as the change in the consumer price index (cpi) compared. The german tax system has a progressive tax.

Read This Guide To Find The Deadlines That Apply In Germany For 2024.

In february 2024, the german parliament adopted the budget for that year, which included:

In 2024, This Income Threshold Will Be Increased To 69.300 Euros Per Year Before Tax.

If you work with a tax advisor, the deadlines have also.

5 January 2024 • 10 Minute Read.

Images References :

Source: www.statista.com

Source: www.statista.com

Chart Where tax returns take the longest in Germany Statista, Read this guide to find the deadlines that apply in germany for 2024. The most important tax changes in 2024.

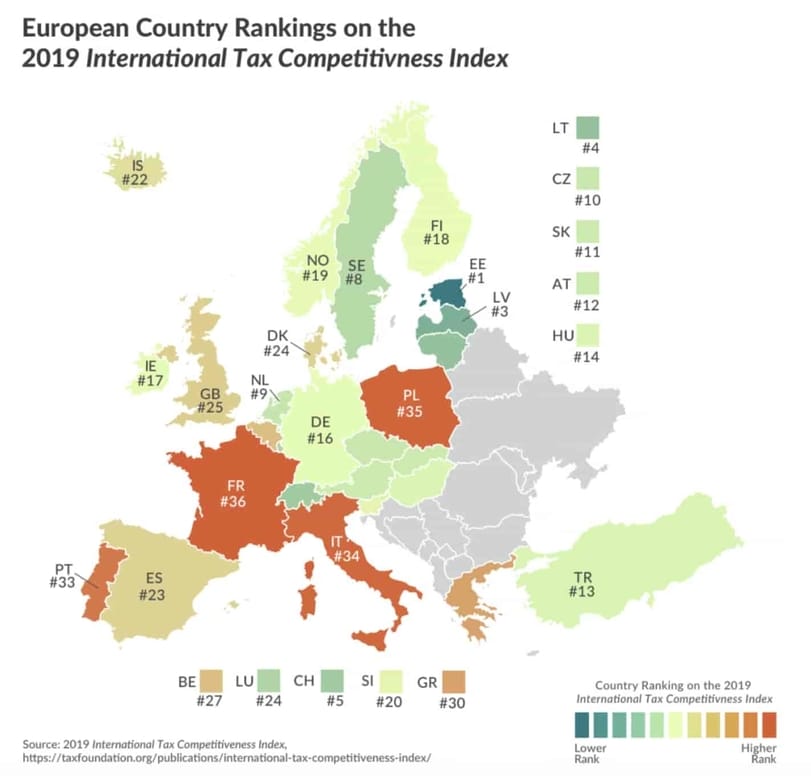

Source: universalhires.com

Source: universalhires.com

Taxes in Germany A Competitive Tax System? Universal Hires, Read this guide to find the deadlines that apply in germany for 2024. Germany has created a fund of €100bn ($108bn) to bolster its armed forces and aims to meet the nato target of spending at least 2% of gdp on defence.

Source: www.worldwide-tax.com

Source: www.worldwide-tax.com

Germany Taxes 2024,Germany Tax,Germany Tax Rates,Germany Economy, Any taxes owed will be automatically withheld by your employer. This registration process grants you a unique tax.

Source: aussiedlerbote.de

Source: aussiedlerbote.de

Financial and tax changes in Germany in 2024, In 2024, the top tax rate (spitzensteuersatz) will therefore apply to an annual income of 66,761 euros (2023: In 2024, there will be a number of changes in germany in the area of vat and other indirect taxes and duties.

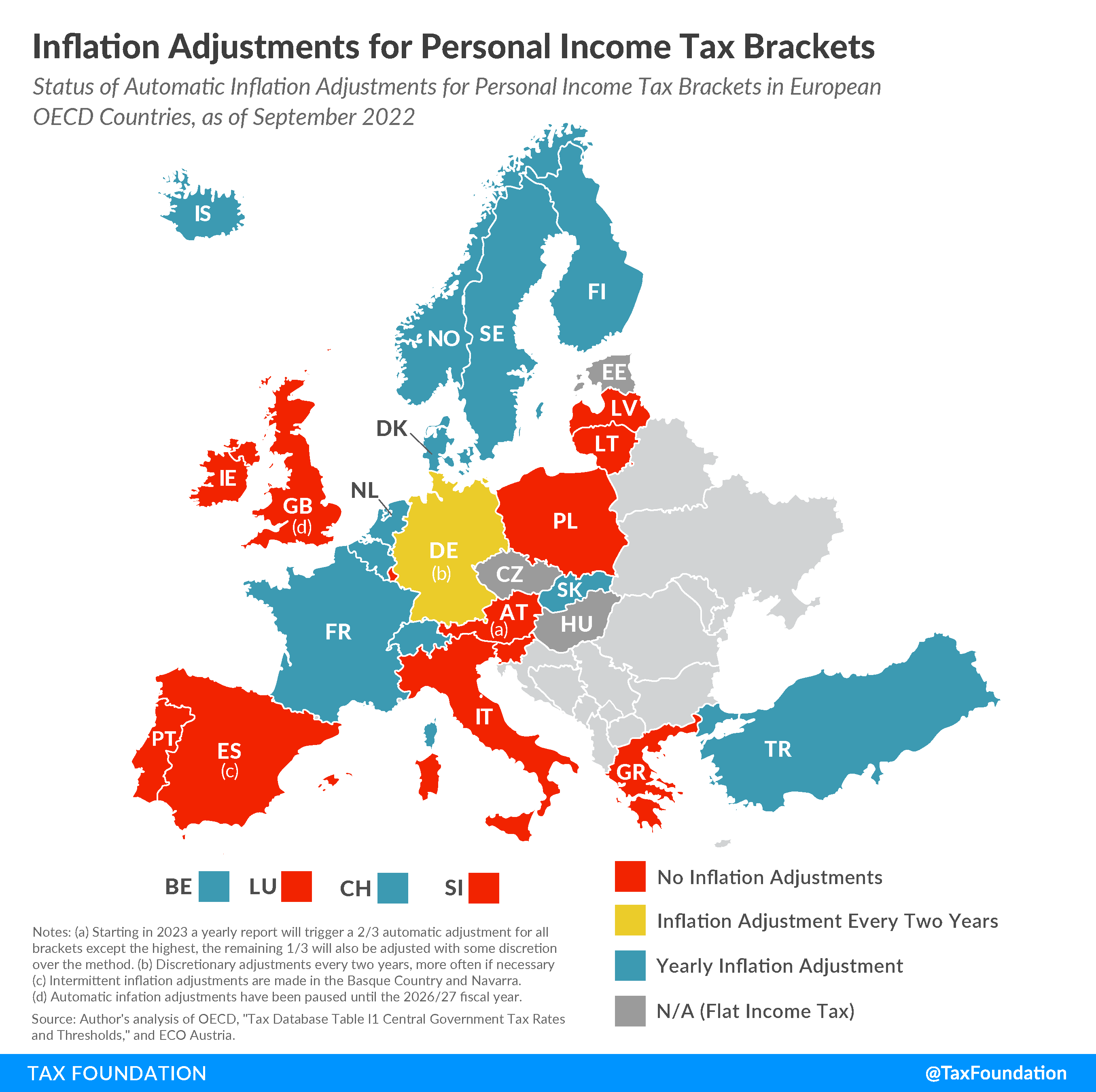

Source: www.cashreview.com

Source: www.cashreview.com

Inflation and Europe’s Personal Taxes CashReview, Germany has progressive tax rates ranging as follows (2024 tax year): A group of the world’s largest airlines have.

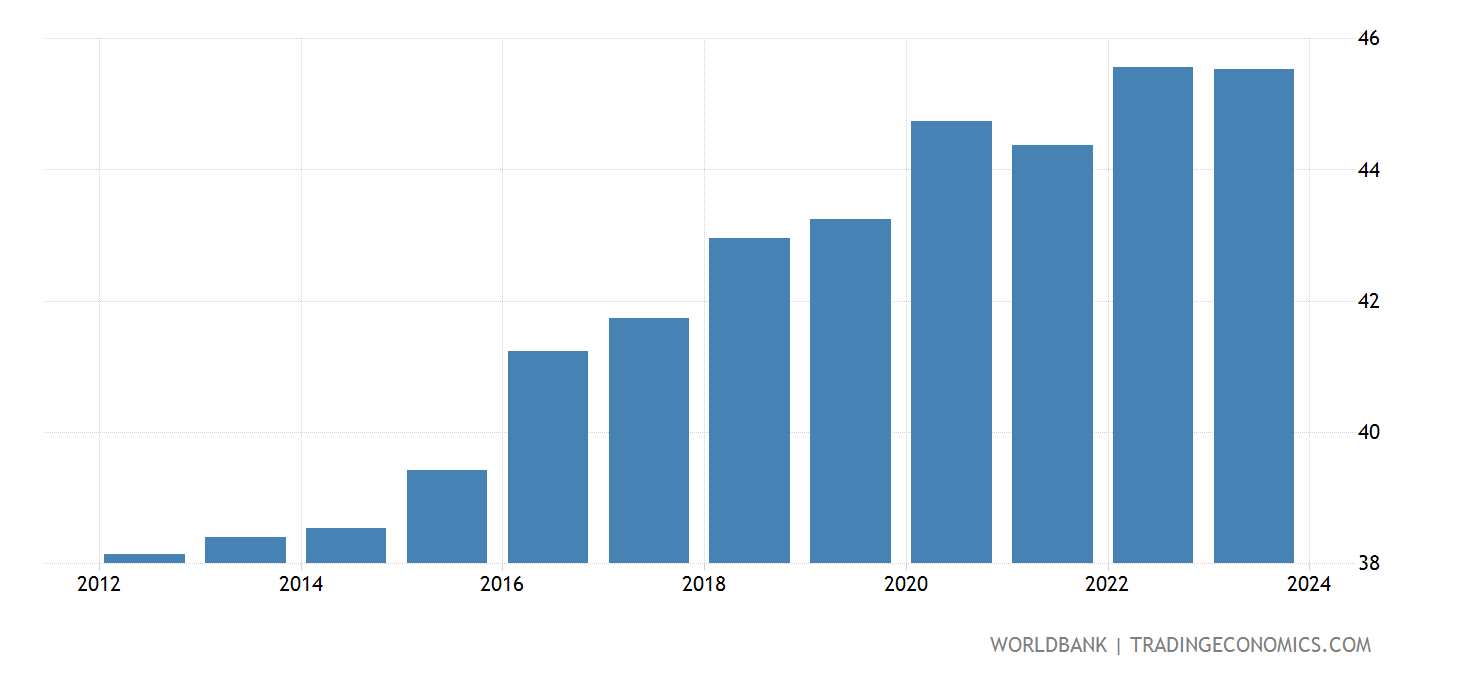

Source: tradingeconomics.com

Source: tradingeconomics.com

Germany Taxes On Profits And Capital Gains ( Of Total Taxes, In 2024, this income threshold will be increased to 69.300 euros per year before tax. Here are the income tax rates for previous years:

Source: ondemandint.com

Source: ondemandint.com

Corporate Taxes in Germany in 2023 Types, Filing Tax Return & Benefits, If you earn or receive money (inheritance or gift), you must pay tax on it. Currently, statutory health insurance plans in germany all charge the same.

Source: www.taxback.com

Source: www.taxback.com

Your Bullsh*tFree Guide to Taxes in Germany, The german income tax rate is high. How much money will be left after paying taxes and social.

![Which Countries Pay The Most Tax? [Infographic]](https://imageio.forbes.com/blogs-images/niallmccarthy/files/2016/04/20160413_Tax.jpg?format=jpg&width=1200) Source: www.forbes.com

Source: www.forbes.com

Which Countries Pay The Most Tax? [Infographic], Germany has created a fund of €100bn ($108bn) to bolster its armed forces and aims to meet the nato target of spending at least 2% of gdp on defence. Upon your arrival in germany, it's imperative to register with the citizen's office within 14 days.

Source: www.mylifeingermany.com

Source: www.mylifeingermany.com

Tax Return in Germany 2024 English Guide My Life in Germany, Currently, statutory health insurance plans in germany all charge the same. Only the maximum tax rate (“wealth tax.

Currently, Statutory Health Insurance Plans In Germany All Charge The Same.

Global tax alert vat and other indirect taxes changes in germany in 2024.

Here Are The Income Tax Rates For Previous Years:

The inflation rate in germany is expected to be +2.2% in april 2024.